Sale Leaseback operational

Real Estate Advisors

SAB Capital’s (“SAB”) Sale-Leaseback Division advises operating companies—those that exist to make products, provide services, and/or administer care. Through our Quality of Leasehold (“QofL”) assessment process, SAB educates companies on how their occupancy is valued across owned and leased properties, how to improve it, and how to use it more effectively. This often reduces fixed costs and unlocks capital to invest in people, processes, and AI that can expand market share and grow income. With over 35 years of combined experience raising over $4 billion, SAB excels in lease monetization solutions that drive enterprise value.

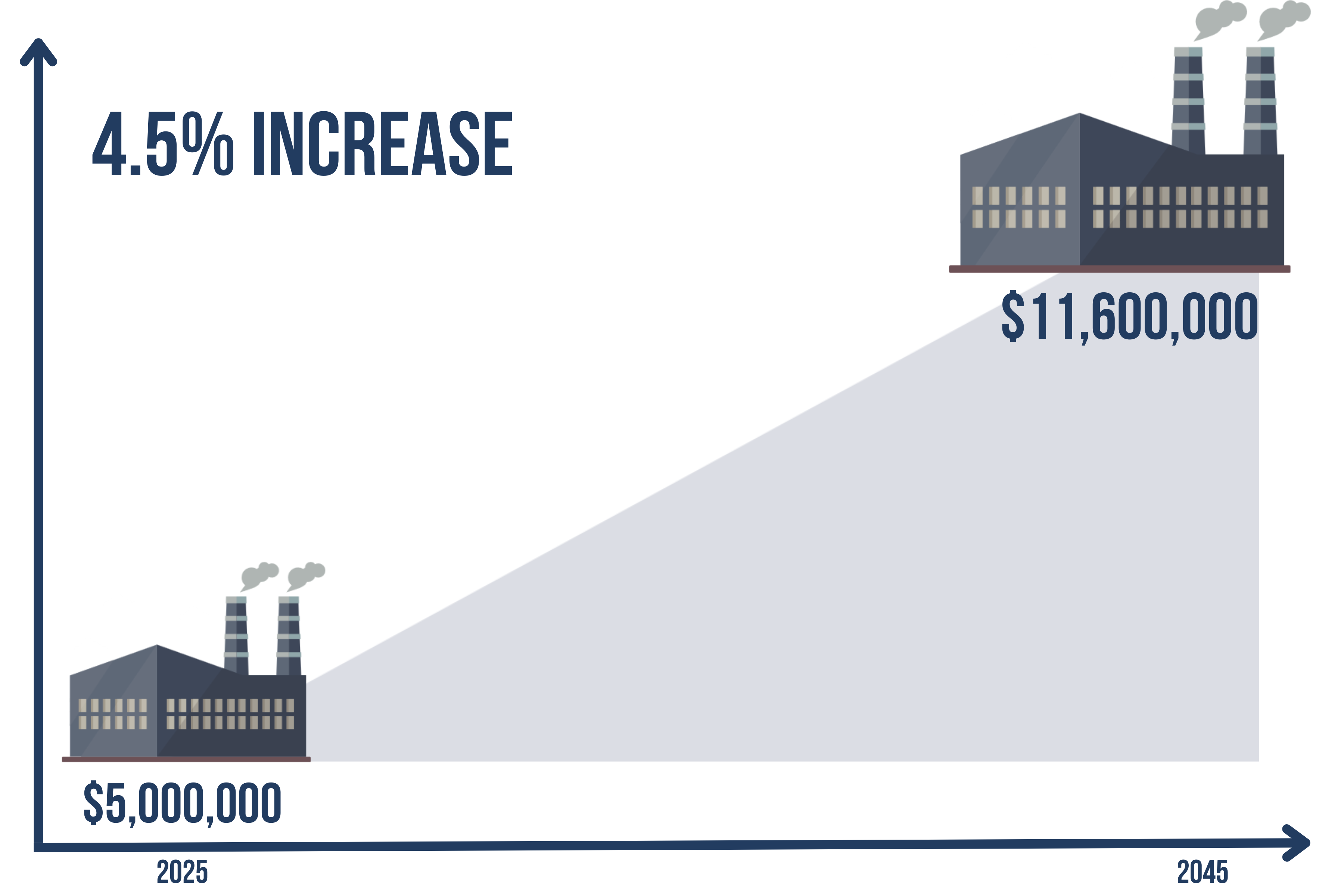

Opportunity Cost of Owning

According to Green Street’s Commercial Property Price Index, US commercial properties appreciated on average 4.50% per year over the last 20 years. Therefore, a $5M investment in a building is expected to take 20 years to double in value.

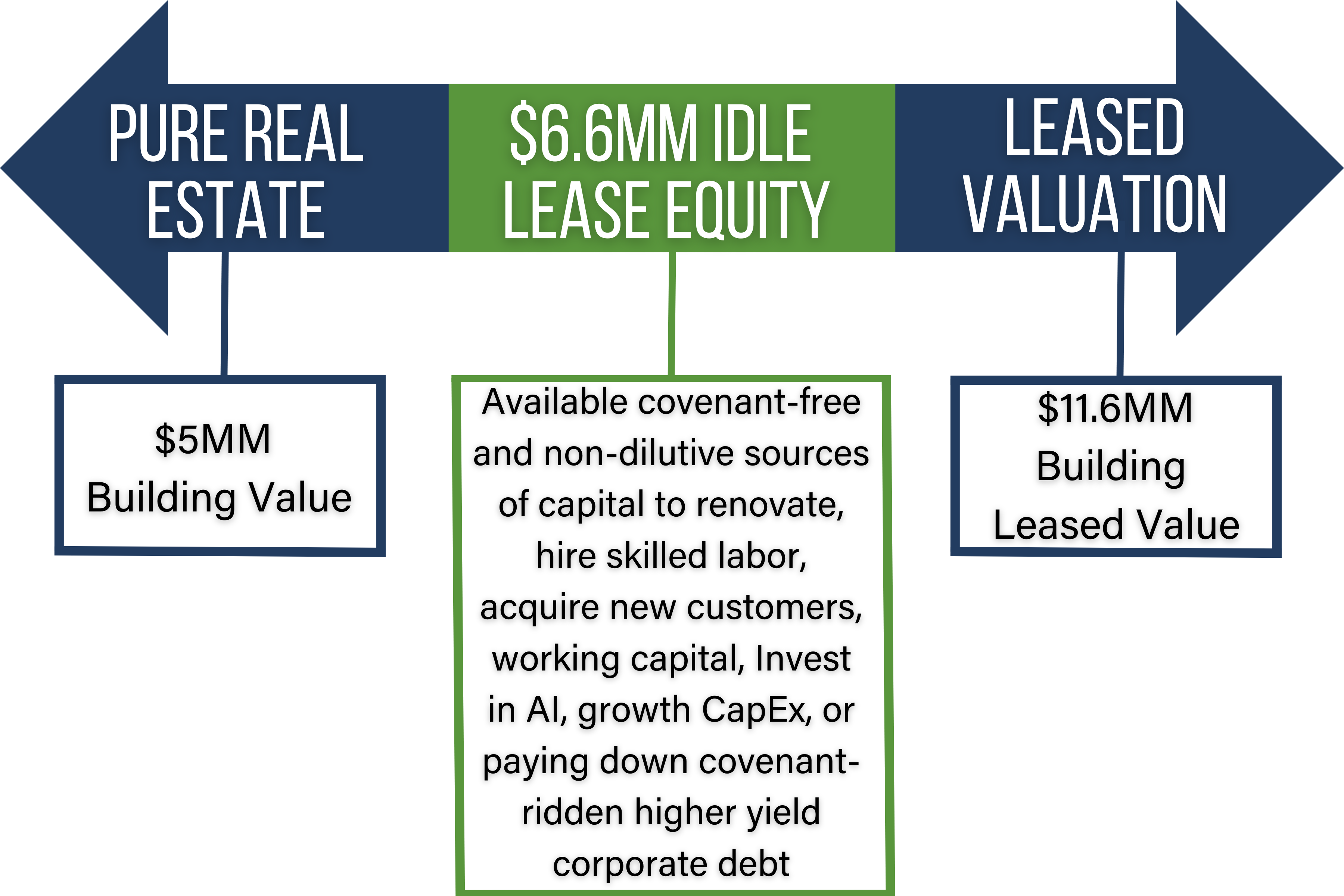

OWNING VS LEASING

Alternatively, offering a lease on the same building today is likely to unlock the same value. If a $5M investment could be monetized for $11.6M today, how could that capital be utilized to drive profitability of my core products + services and expand market share without relinquishing operating control of the building(s)?

Value of Tenancy

Recent Mandates

| Tenancy Profiles | Transaction Profiles | Proceeds Raised | Use of Proceeds |

|---|---|---|---|

| Building Products | Sale Leaseback | $10M | Growth Equity, Acquisition Financing |

| Food + Bev Mfg | Sale Leaseback, Build-to-Suit | $70M | Growth Equity, Acquisition Financing, Debt Repayment |

| Metal Fabrication | Sale Leaseback | $10M | Acquisition Financing |

| Plastic Molding + Mfg | Sale Leaseback | $5M | Debt Repayment |

| Commercial Printing | Sale Leaseback | $73M | Acquisition Financing |

| Aerospace & Defence | Sale Leaseback, Build-to-Suit | $10M | Debt Repayment |

| Personal Care Co-Mfg | Sale Leaseback | $35M | Dividend |

| Autism Therapy | Sale Leaseback | $25M | Growth Equity, Debt Repayment |

| Railroad Equipment | Sale Leaseback | $22M | Recapitalization |

| Auto + Truck Distribution | Sale Leaseback | $19M | Recapitalization |

| Energy Equipment Mfg | Sale Leaseback | $20M | Debt Repayment |

| Framework + Hardware | Sale Leaseback | $38M | Growth Equity |

| Dealership | Sale Leaseback | $13M | Debt Repayment |

| Steel Distribution | Sale Leaseback | $10M | Acquisition Financing |

| Equipment Rental | Sale Leaseback | $10M | Dividend |

| Water Management Solutions | Sale Leaseback | $9M | Growth Equity, Debt Repayment |

| Dermatology | Sale Leaseback | $5M | Dividend |