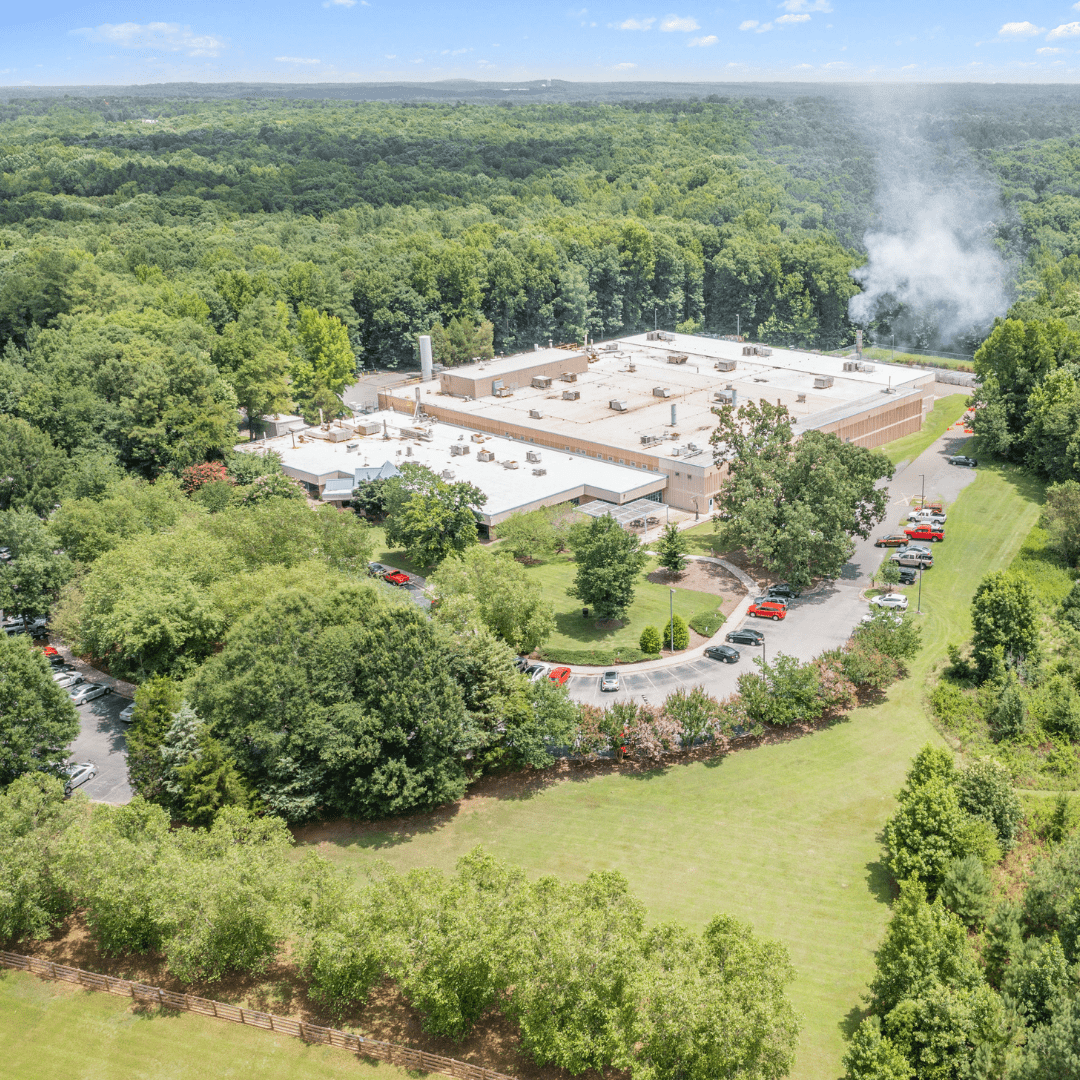

SAB Capital, a New York City-based investment sales firm, executes a $20MM sale and leaseback of a 2-property industrial portfolio for a catalyst manufacturer providing emission-control products for power generation plants. The properties are located in North Carolina’s Research Triangle and Tennessee’s Chattanooga MSA.

In this deal, SAB’s Sale Leaseback Director Bryan Huber ran a process that generated nearly a dozen offers and ultimately put the properties under accepted-LOI within 18 days of launching outreach. SAB’s transaction team subsequently negotiated two leases, managed third-party diligence orders, and closed the transaction in 37 days. The team’s swift execution was critical to providing the seller/tenant with sufficient runway to pay off their maturing debt and prepare for their entrance into carbon capture markets.

“This was a fantastic outcome for both the buyer and seller. The seller was left with sufficient runway to pay down their credit facility and prepare for their entrance into carbon capture markets, while the buyer was able to put capital to work in a highly-educated market with a growing population.” – Bryan Huber – Director of Sale Leaseback group at SAB Capital

For more information regarding this opportunity, please contact Bryan Huber (646) 809-8845 | bhuber@sabcap.com